Cars are very expensive and it is very important for you to make sure that the way you're choosing to finance your car is the best way possible for you depending on your budget and in-hand cash.

Reading Time: 4 minutesWhen you think of buying a car, it might seem like a simple decision but there are a lot of things and steps that you’ve to take into consideration.

Cars are very expensive and it is very important for you to make sure that the way you’re choosing to finance your car is the best way possible for you depending on your budget and in-hand cash. What might seem like the best financing over to someone else might not be the one for you so make sure you don’t get influenced by anyone else and do what seems the best for you. Aim Motors provides best car finance services in Edinburgh to all of its customers. Below are some tips on get finance on your next car.

1. Purchasing through cash

This is the best, simplest, and cheapest way out there to buy a car if you have the amount fully in cash or at least a part of it.

If you do pay the entire cost of the price in cash, then you’ll own the car immediately. You won’t have to undergo interest in the car.

It will be under your name so you can sell it at any time if you want to. If you’re a finance agreement then the car is not under your name rather is under the finance provider’s name so you cannot sell the car no matter what happens.

Also, Aim Motors buys cars for cash as well. Just come up with your car, and Aim Motors will buy your car based on its condition.

You won’t have to worry about having a good credit score or the monthly bills etc.

However, this could limit the car options for you as you’ll have a specific price range in mind depending on how much you can immediately pay.

Also, when you are deciding to pay money through cash, make sure you’re leaving a good amount of money for other bills like insurance and maintenance, etc.

This also will give you an upper hand when considering deals because you’re financing the car yourself rather than relying on someone else or the dealership so in this way if a deal does not satisfy you or your needs then you have the full right to walk away at any point.

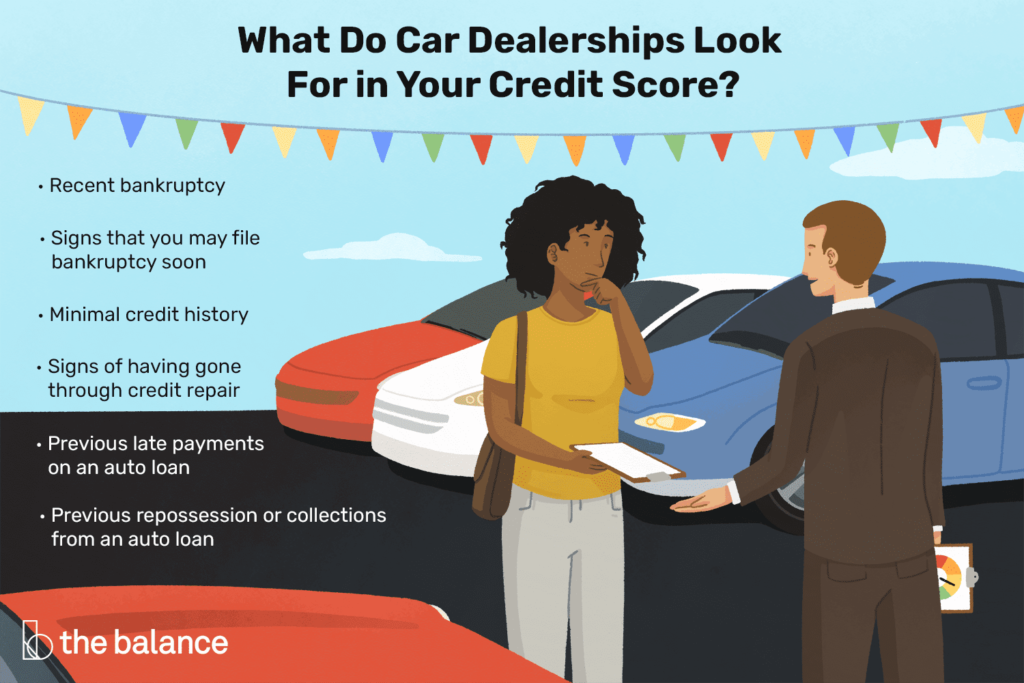

2. Credit scores and car finance

This is the best way to finance a car if you don’t have the set amount of money in cash. Having a good credit score can actually get you the best deals for car financing.

Through good credit scores, you’re permissible to loan a larger amount of money. Although, just because of this don’t search for cards outside of your budget. Think about the long-term process and see whether you’ll be able to afford it in the long run including all the extra expenditures.

A lot of times, people end up losing track or getting behind on car payments because they think they can afford the car but it goes out of budget when all other expenses are added, so this is a very important step to keep in mind when thinking about purchasing or financing a car.

A good credit score does give you a lot of benefits but that in no way means that if you have got a bad or average credit rating you can’t buy a car. You can buy a car with bad credit score as well, the deals just won’t be as amazing.

3. Purchasing by getting a loan

If the option of monthly payments and high-interest rates for something you don’t own right off the bat seems unjust to you then you can opt for getting a loan from the bank.

If you’ve maintained a good credit score then you can easily get a loan and have it spread to be returned anywhere between 1 to 7 years depending on how much you think you can pay monthly.

Although, when getting a loan try not to get it secured against your home because then your house will be at risk for any shortage in payment at any point.

You can apply for finance online with Aim Motors and get an instant decision on your application within a day.

Even though sometimes, the interest rates could be higher than you’d think but the benefit of this would be that you’ll have the ownership of the car right away and this way if anytime you feel like you’re not able to pay the loan, you can sell the car. Obviously, search around for the cheapest interest rate that best suits you.

4. Credit card usage for buying a car

If you buy a car through a credit card and pay all or at least some of the amount beforehand through it. You’ll gain extra protection if something goes the wrong turn. Of course, this is only if you pay your monthly bills on time.

But this option is not available for all dealers and some even take a card handling fee so keep this in mind when you think of going after this option.

With Aim Motors, we accept almost most of the credit cards. If you wish to inquire, just leave us an email on sales@aimmotorsltd.co.uk and our sales team will get back to you within an hour.

Credit cards also have very high-interest rates so try to look for a deal that takes 0% interest so in this way you can pay off the loan slowly without having to worry or deal with interests. However, it’s hard to find 0% deals so try to pay the bill off immediately to keep away interest.